Teguh Anantawikrama. Foto: Dolumentasi pribadi/ukmdanbursa.com.

By Teguh Anantawikrama

Vice Chairman, Indonesian Chamber of Commerce (KADIN)

UKMDANBURSA.COM – The latest U.S. jobless claims report has come in lower than expected, reaffirming the resilience of the American labor market. At first glance, this looks like a simple data point.

In truth, it is a signal with far-reaching implications. These implications affect not only the U.S. dollar but also global trade, including Indonesia.

A stronger U.S. dollar can be both a blessing and a burden. For Indonesia, the ripple effects can shift our trade balance, capital flows, and even the pace of our domestic reforms. To navigate this, we must think in scenarios—not wishful thinking—so that our responses are grounded and proactive.

Read more:

Learning from China’s Fiscal Response to Trade Shocks

Scenario 1: A Sustained Strong Dollar

If the U.S. labor market continues to defy expectations and the Federal Reserve maintains higher interest rates, the dollar will remain strong.

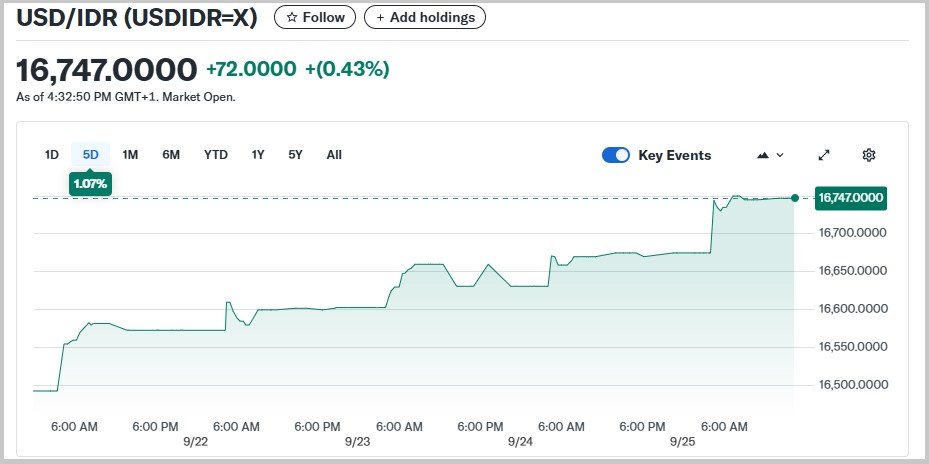

In this situation, Indonesian exports—from palm oil and coal to textiles and footwear—gain competitiveness. Yet imports from the U.S., particularly machinery, soybeans, and technology, become more expensive. The Rupiah would weaken modestly, creating imported inflation risks.

Source: textiletoday / BPS / ukmdanbursa.com.

Policy response here must be twofold:

1. Bank Indonesia (Indonesia’s Central Bank/BI) should prepare selective interventions and modest rate adjustments.

2. Government ministries must accelerate local currency settlement (LCS) with trading partners to reduce dependency on the dollar.

This scenario benefits our exporters but tests our importers and corporates with U.S. dollar debt.

Scenario 2: A Softer Dollar Emerges

Should the U.S. economy cool and the Fed pivot to rate cuts, the dollar would weaken.

Indonesia would enjoy cheaper imports, lower inflationary pressure, and renewed capital inflows. Access to U.S. technology and capital goods would support our industrial upgrading, while foreign investment would return to our markets.

Here, the challenge is maintaining export momentum when competitiveness softens. The policy priority should be:

• Shoring up value-added exports through downstreaming — nickel, electric vehicle (EV) batteries, agro-industry.

• Using the breathing space of a softer dollar to strengthen domestic capital markets and lower financing costs for Micro, Small, and Medium Enterprises (MSMEs).

Read more:

World Reset or Survival of the Fittest?

Scenario 3: A Dollar Shock

The real test lies in the shock scenario: a dollar that grows too strong, not only strengthening but destabilizing. This would trigger capital outflows from emerging markets, squeeze countries with high dollar-denominated debt, and depress global commodity prices.

For Indonesia, such a scenario means sharp Rupiah depreciation, surging inflation, and financial stress for corporates and MSMEs. Exports may grow in volume but decline in value as global demand weakens. This is stagflation risk.

The policy response must be decisive:

• Bank Indonesia may need emergency measures, including rate hikes and bilateral swap line activation with China, Japan, and ASEAN partners.

• Government ministries should double down on import substitution and fast-track domestic production of strategic goods.

• Investors and entrepreneurs must adapt by hedging exposure and leaning on regional trade ecosystems.

This is where Indonesia’s resilience will be tested, and where the urgency of reducing dollar dependency becomes undeniable.

The Strategic Imperative

Across all three scenarios, one truth stands out: Indonesia cannot remain overly exposed to the volatility of the U.S. dollar. Our long-term resilience lies in:

• Diversification of trade settlements through local currencies.

• Downstreaming commodities to capture higher value in global supply chains.

• Strengthening domestic markets to absorb shocks.

Indonesia is no stranger to turbulence. Each crisis we have endured has forced transformation. The U.S. dollar will remain a global anchor, but we must ensure it does not anchor our future growth.

In moments of volatility, strategy matters more than reaction. By preparing for each scenario, Indonesia can move from being a passenger of global tides to a navigator of its own course. ***

7 thoughts on “Strong Dollar, Fragile Balance: What Indonesia Needs to Prepare For”